Excellent Reasons For Choosing Credit Card Apps

Wiki Article

What Can I Do To Determine If My Credit Card Issued In The Us Is Reported Lost?

Check these steps to determine whether your credit card has been reported stolen in USA: Contact your credit card provider

Contact customer support at the number located on the back of the card.

The representative can be asked to confirm the status of your card.

It is possible that you will be required to reveal information regarding your personal identity and credit card to verify your identity.

Log in to your account

Log into your online banking or card account linked to your card.

Watch out for any notifications or alerts that may pertain to the current status of your card.

Check your recent transactions for suspicious or unauthorized transactions.

Monitor Your Credit Report

Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) through AnnualCreditReport.com.

You should look over your credit reports for any suspicious inquiries or unidentified credit accounts.

Fraud Alerts (and Security Freezes)

Consider putting a fraud alert or security freeze on your credit report If you suspect fraud or theft of personal information may have occurred.

A fraud notice alerts lenders to confirm your identity prior to they extend any credit. The security freeze, on the other hand is a restriction on access to your credit report.

Keep an eye on suspicious behavior and report it. Behavior

Monitor your credit card statement regularly and immediately make a report of any suspicious or illegal transaction.

Inform any suspicious cases for investigation to the Federal Trade Commission. You may also file a complaint at the police station in your area.

By contacting the issuer of your credit cards, examining your account's activity on your website, monitoring your account and looking out for any indications of an unauthorised activity, proactive steps can be taken to protect you against credit fraud, and also solve any issues that could arise due to stolen credit.

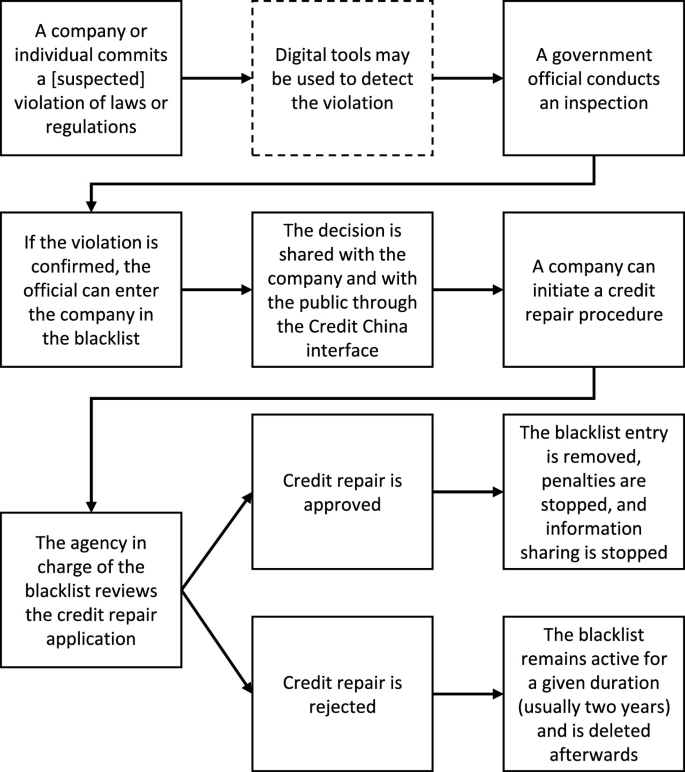

What Do I Do If My Credit Card Is On The "Blacklist"?

Follow these steps in case you suspect that your credit card is on"blacklist "blacklist" or you suspect fraud with the card: Call your credit card issuer immediately-

Call the customer care number on the reverse of your credit card. Check the issuer’s website for a hotline that is exclusive to report fraud.

Inform the issuer about your concerns, stating that you suspect fraud or that your card might be compromised.

Report Suspicious Activity-

Please explain any unusual transactions or purchases you've seen on your credit card statement.

Provide specific details about the transactions in question such as dates, amount, and merchant names if available.

Request Card Replacement or Blocking

Request that the issuer of your credit card temporarily block your card in order to keep any future transactions from being unauthorized.

Find out the procedure for changing the card to a brand new one that allows you to have access to credit.

Review Your Account and Dispute Charges -

Review your most recent statement of account and transaction to see if you missed any suspicious activities.

You can report unauthorized transactions to the credit card company so that they will be examined and then resolved.

Monitor and follow up on your creditscore

Make sure to contact your credit card company to see whether the issuer took the correct steps to resolve any issues you might face.

Watch your account regularly to spot any modifications or suspicious activity.

Consider Placing a Fraud Alert or Security Freeze

Depending on the severity of the issue, you may consider placing an alert for fraud or a security freeze on your credit file to prevent further fraudulent attempts or to protect yourself from identity theft.

The report is sent to Authorities-

Consider making a report of identity theft and other major frauds to the Federal Trade Commission. You may also file a complaint with the law enforcement agency in your area.

It is important to act promptly to stop any more fraudulent transactions from happening and minimize the potential loss. You can minimize the impact of credit card fraud and misuse by reporting suspicious transactions immediately to your credit card provider.

What Are The Requirements For An Individual To Be Able To Put The Credit Card Number On A List App?

These professionals include: Fraud Analysts- Trained people within financial institutions who are experts in identifying and investigating fraudulent activities related to credit cards. They include Fraud analysts - trained individuals who work within banks and specialize in identifying, investigating, and the prevention of fraudulent credit card transactions. They use software and tools that are specifically designed to identify patterns and anomalies. They may also discover compromised card information.

Cybersecurity Experts- Professionals specializing in cybersecurity, focusing on the monitoring and detection of cyber threats, including compromised credit card data. They are accountable for preventing data breaches as well as analysing data to identify the signs of compromise.

Law enforcement officials are individuals or units of the law enforcement agencies who are specialized in financial crimes, such as credit card fraud. They have the databases and resources necessary to track fraudulent activity.

Compliance Officers – These professionals are responsible for ensuring that financial institutions follow regulations and laws relating to financial transactions. They are also responsible for overseeing processes for identifying suspicious activity related to credit card.

Access to databases that are blacklisted by credit card blacklists is strictly controlled and requires legal authorization. Examples include being a part of an official investigation into financial crimes, and being granted specific permissions by authorized entities are examples.

Teams and professionals utilize specific programs, protocols and legal procedures to check credit card numbers with blacklists. They are also obligated to adhere to strict privacy rules and security guidelines. In the event of concerns about possibly compromised credit card information It is essential to trust professionals and institutions that are authorized. Any attempts to access credit card information that are not authorized or using blacklists for credit cards could have legal consequences. Follow the top rated savstaan0.cc for blog examples.