3 Best Ways For Investing Your Savings in 2024

Wiki Article

What Are The Best Ways To Invest Into The Stock Market Of 2024?

Investing in the stock market in 2024 can be accomplished through different strategies, each tailored to different risk tolerances and investment goals. Diversified Index Funds (DIFs) and ETFs are among the top ways to invest this year on the stock markets.

S&P 500 Index Funds Investing into funds that follow S&P 500 offers broad exposure to U.S. large-cap stocks and an enlightened return-risk profile.

Thematic ETFs. ETFs that focus on emerging trends such as artificial intelligence, renewable energies and biotechnology can profit from the growth of certain sectors.

Dividend Stocks:

Dividend Stocks That Pay High Yields - Companies who pay high dividends consistently can be an income source that is reliable, especially in volatile markets.

Dividend Aristocrats: These companies have boosted their dividends by at least 25 years consecutively which is a sign of financial stability.

Growth Stocks

Tech giants. Apple, Microsoft, Amazon and a host of other companies are continuing to show high growth potential, due to their unique products and their dominant market position.

Emerging Tech Companies investing in smaller, more innovative tech companies could provide the highest growth potential, but they carry higher risks.

International Stocks

Emerging Markets - Countries such as China, India, Brazil and others are experiencing rapid economic growth.

Diversifying into European and other developed markets could provide stability and help grow away from established economies.

Sector-Specific Investments:

Technology is still one of the most significant industries thanks to its advances in AI and cybersecurity.

Healthcare: The aging population and the continuous advancement in medicine make this sector resilient.

Renewable energy investments are rising because sustainability in the world is an important factor driving the development of green, wind and solar energy sources.

Value Investing:

Stocks Undervalued: Search for companies that have strong fundamentals, but that trade below their intrinsic values. They can provide significant profits if the market corrects them.

ESG (Environmental, Social, and Governance Investment):

Sustainable Businesses. The decision to invest in companies that follow ESG practices is aligned with your personal values. It can even yield a positive return since sustainability is becoming more important to regulators as well as consumers.

REITs (Real Estate Investment Trusts):

Commercial and Residential Real Estate Investment Trusts (REITs): These REITs provide exposure to the market, without having to own physical properties. They also pay dividends, and are able to provide capital appreciation.

Options and derivatives:

Sell covered calls and earn income with your existing stocks.

Buy Puts to Protect Your Stock: Purchasing puts will help you safeguard against a possible fall in the price of your stocks.

Robo-Advisors and Automated Investment:

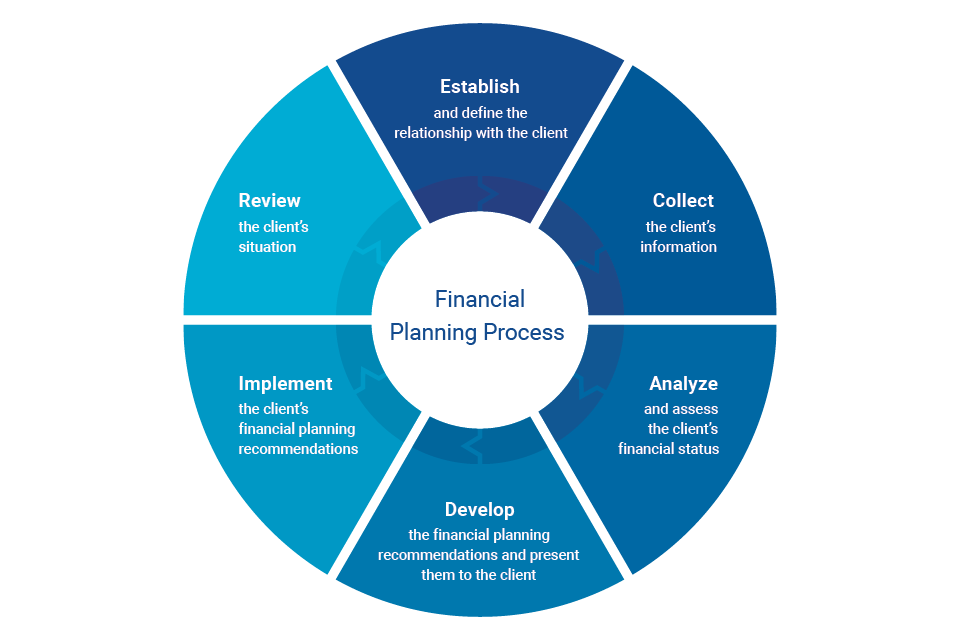

Robo-Advisors: Platforms such as Betterment and Wealthfront offer automated financial planning, based on algorithms with diversified portfolios designed to meet your risk tolerance and investment goals.

The Year 2024: Additional Tips

Keep yourself informed. Keep an eye on developments in the markets, economic indicators and geopolitical developments that may affect the stock market.

Long-Term Perspective: Concentrate on long-term growth rather than short-term gains in order to cushion market volatility.

Risk Management: When constructing your portfolio, make sure you diversify your investments.

Rebalance and review. Review and regularly make sure your portfolio is balanced to keep your desired allocation of assets and to maximize opportunities on the market.

You can maximize your stock market investment in 2024 through combining these strategies and remaining flexible to the market conditions. Read the top rated Cross Finance hints for website tips.

What Are The 10 Best Ways To Invest In Startups And Private Equity Investments?

Investing private equity and in startups can provide significant returns, however it is also associated with risk. Here are the top investments for 2024 in startups and private capital:

1. Angel Investing

Direct Investment: Invest in startups at an early stage, typically in exchange for equity. It is typically a smaller investment than conventional venture capital.

Angel Groups Join an angel group or investing network to pool your resources and conduct due diligence. This can increase the investment possibilities for you and decrease your risk as an individual.

2. Venture Capital Funds

Venture Capital (VC) Funds invest in professionally managed VC funds that pool capital from several investors to invest in a diversified portfolio of companies. This allows you to gain access to high-growth businesses that are professionally managed and are subject to due diligence.

Micro-VC: Smaller, more focused funds that focus on early stage startups with high risk/reward.

3. Equity Crowdfunding

Online platforms: You can invest in startups through crowdfunding for equity using platforms like Crowdcube as well as Wefunder. These platforms accept smaller investments in exchange for equity, and facilitate startup investment.

Due diligence: Take the time to evaluate the business plans, the market potential and the team behind each startup before investing.

4. Private Equity Funds

Buyout funds: Investing in a private equity fund that is able to restructure and acquire mature businesses with a view to operational improvements and eventual profits.

Growth Equity Funds They invest in businesses that are mature and require capital to expand, go into new markets or finance large acquisitions.

5. Secondary Market Funds

Liquidity Solutions Investing secondary market funds to purchase stakes from investors already through private companies may provide more liquidity, and may even lower the entry price.

6. Fund of Funds

Diversification. Invest in an investment fund that pools capital to multiple venture capital and private equity funds. This will provide broad diversification over various sectors.

7. Special Purpose Vehicles

Targeted Investments: Join SPVs which are designed to pool investors' money in one investment in an individual company or opportunity, allowing for targeted and strategic investment.

8. Direct Investments

Private Placements - Companies sell securities direct to buyers who are accredited, offering an opportunity to invest in high-potential companies.

Strategic Partnerships Create strategic partnerships or co-investment arrangements with other investors or funds to benefit from expertise and share risk.

9. Incubators, Accelerators

Mentorship and funding You may invest in incubators & accelerators which provide seed capital, mentorship and other services to startups at an initial stage in exchange for equity.

10. Self-directed IRAs

Tax-Advantaged IRA Accounts: You could make use of a self-directed IRA for investing in startups and private equity. This lets you benefit from tax-advantaged gains. Keep up-to-date to IRS rules to stay clear of penalties.

Other Ideas for 2024's Year

The importance of diligence is paramount:

Market Research: Assess the market potential as well as competition and the scalability of your business.

Management Team: Go over the management team to assess their experience, track records and capabilities.

Financial Projections Review the health of the business's finances and forecasts. your business.

Diversify Your Portfolio:

Divide your investments across various sectors, startups, and stages to maximize returns and minimize risk.

Understand the Risks:

Consider the risk of investing in private equity, startups and venture capital. It is possible to be unable to recover your entire investment. Don't allocate more than a portion your portfolio to these investments.

Network and Leverage expertise:

Establish connections with experts from industry, investors and venture capitalists to gain insight and access to investment opportunities of high quality.

Stay up-to-date with the latest trends:

Be aware of the latest developments in the industry, as well as new technologies and economic developments that can affect the private equity and startup landscape.

Compliance with the law and regulations:

All investments must comply with all regulatory and legal requirements. Consult financial and legal advisors for help navigating the maze of investing in private firms.

Exit Strategy:

Knowing your exit strategy for investments is crucial, regardless of whether you are planning to sell, merge and purchase, or perform secondary sales.

If you follow these methods and staying well-informed and informed, you will be able to invest successfully in private equity and startups. You can balance high potential returns with prudent risk control in 2024.

What Are The Most Effective Mutual Fund Investment Options For 2024?

Mutual funds can be a fantastic option to diversify portfolios with professional management, and have access to various types of assets. Here are a few of the best mutual fund investments to consider for 2024. Index Funds:

Broad Market Index Funds These funds are based on important indices, like the S&P 500. Low fees and steady returns permit the fund to offer exposure across a range of large U.S. stock companies.

International Index Funds. These funds track the indexes of foreign markets. This provides diversification, and gives exposure to global growth.

Sector-Specific Funds:

Technology Funds - Investing in funds focused on tech companies will allow you to profit from the rapid growth of certain areas like AI cloud computing, and cybersecurity.

Healthcare Funds - These funds invest in companies producing pharmaceuticals biotechnology, medical devices and biotechnology, taking advantage of an aging populace and medical advances.

Bond Funds:

Government Bond Funds (GFF): These funds are invested in U.S. Treasury securities, or other government bonds which generate income and stability, especially in times of uncertainty.

Corporate Bond Funds They invest in bonds issued by corporations that offer better yields than bonds issued by government agencies, but slightly more risk.

Municipal Bond Funds: These funds focus on bonds that are issued by both state and local governments. They often offer tax-free returns that make them appealing for investors with high incomes.

Balanced Funds

Allocation Funds mix bonds, stocks and other investments into a balanced portfolio that offers the potential for growth with income and low risk.

Target-Date Investment Funds The funds were developed to aid in planning for retirement. They automatically adjust the asset mix as the target dates approaches.

ESG Funds

Sustainable Investing Funds that focus on companies with strong social, environmental and governance practices, appealing to investors who are socially conscious and may benefit from the increased emphasis placed on sustainability.

International and Emerging Funds

Funds for Developed Markets: Investments in the markets of countries that are developed outside the U.S. can provide diversification and exposure to stable economies.

Emerging Market Funds They invest in emerging economies, offering higher growth potential however, they also carry a greater risk due to political and economic instability.

Real Estate Funds:

REIT Mutual Funds by investing in Real Estate Investment Trusts, you will be able to gain exposure to real estate markets without actually owning any property. These funds provide dividends, as well as the possibility of capital appreciation.

Dividend Funds:

High Yield Dividend Funds: These funds are geared towards companies that pay high dividends that provide an ongoing income stream as well as the potential for capital appreciation.

Dividend Growth Funds: Invest in companies with a history of consistently increasing their dividends, indicating strong financial health and growth potential.

Small-Cap and mid-Cap funds:

Small-Cap Funds investing in small-sized companies has a great potential for growth, however it comes with a higher level of risk and uncertainty.

Mid-Cap Funds Invest into mid-sized businesses, and balance their growth potential with stability.

Alternative Investment Funds

Commodities Funds Invest in commodities such as gold, oil and silver. They offer a security against economic recessions and rising inflation.

Hedge Fund Replication Funds: These mutual funds aim to imitate the strategies of hedge funds and offer sophisticated investment strategies with greater liquidity and lower costs.

Other Tips for 2024

Expense Ratios: Pay particular attention to fees that come with mutual funds. Lower expense ratios can have an impact on the long-term performance.

Diversification: Spread your investments across various funds in order to spread risk and increase potential returns.

Performance history: Take a look at the performance history However, remember that past results are not indicative of future performance.

Professional Advice: Speak to a financial advisor regarding making your mutual funds investments to suit your financial goals, your tolerance to risk and your time to maturity.

Automated Investment Plans - A lot of mutual funds offer plans that allow you to invest regularly. You can benefit of the dollar cost averaging process, and your investment will expand as time passes.

Selecting mutual funds that match your investment strategy and remaining up-to-date on market trends in 2024, you will be able to optimize your mutual fund investments.